Tag: TARGET

Tassi negativi, Target2, e la fragilità dell’Eurozona

More Target2 divergence: This time is different

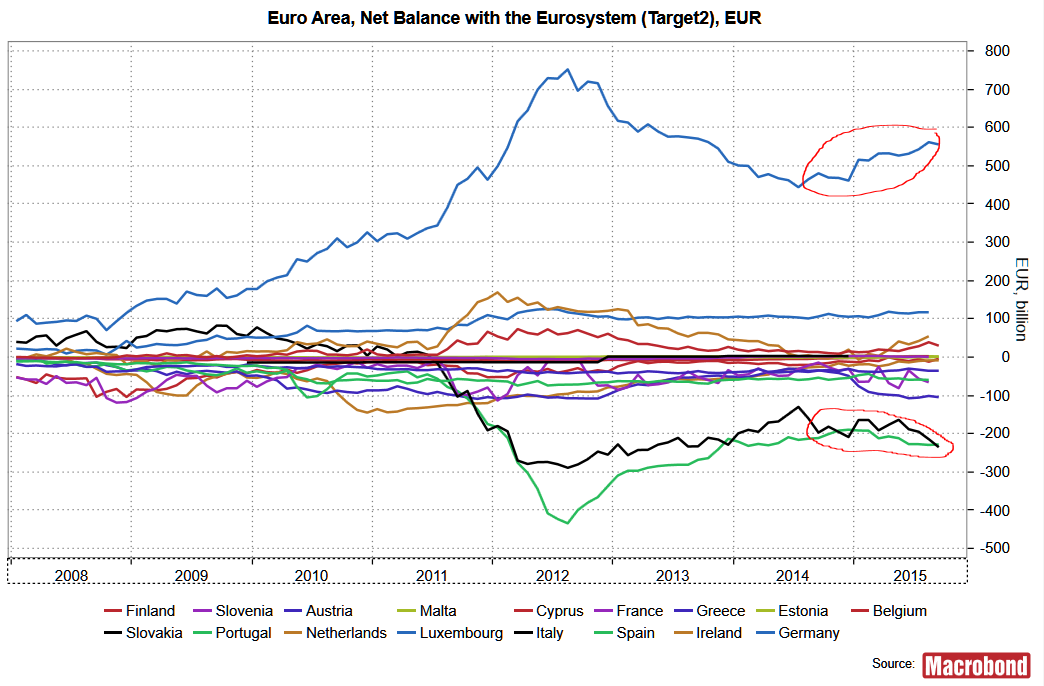

In the midst of the Eurozone “sovereign debt” crisis and increasing spreads in 2010-11, interbank lending came to a halt. At the same time, bank clients were moving funds from the banks of the countries “in trouble” to the banks based in “safe countries”. Because “core” banks were not willing to lend liquidity back to them, “periphery” banks borrowed from the Eurosystem to settle their payments, and Target2 balances diverged. This ended with Draghi’s “whatever it takes” announcement in the Summer of 2012 and the introduction of OMT in the ECB’s toolbox.

What is happening today (SEE CHART) is very different, and does not reflect a “flight to safety” as it did back then. Today’s divergence is a consequence of the ECB asset purchase program (QE), as well as of the current levels of policy interest rates set by the ECB.