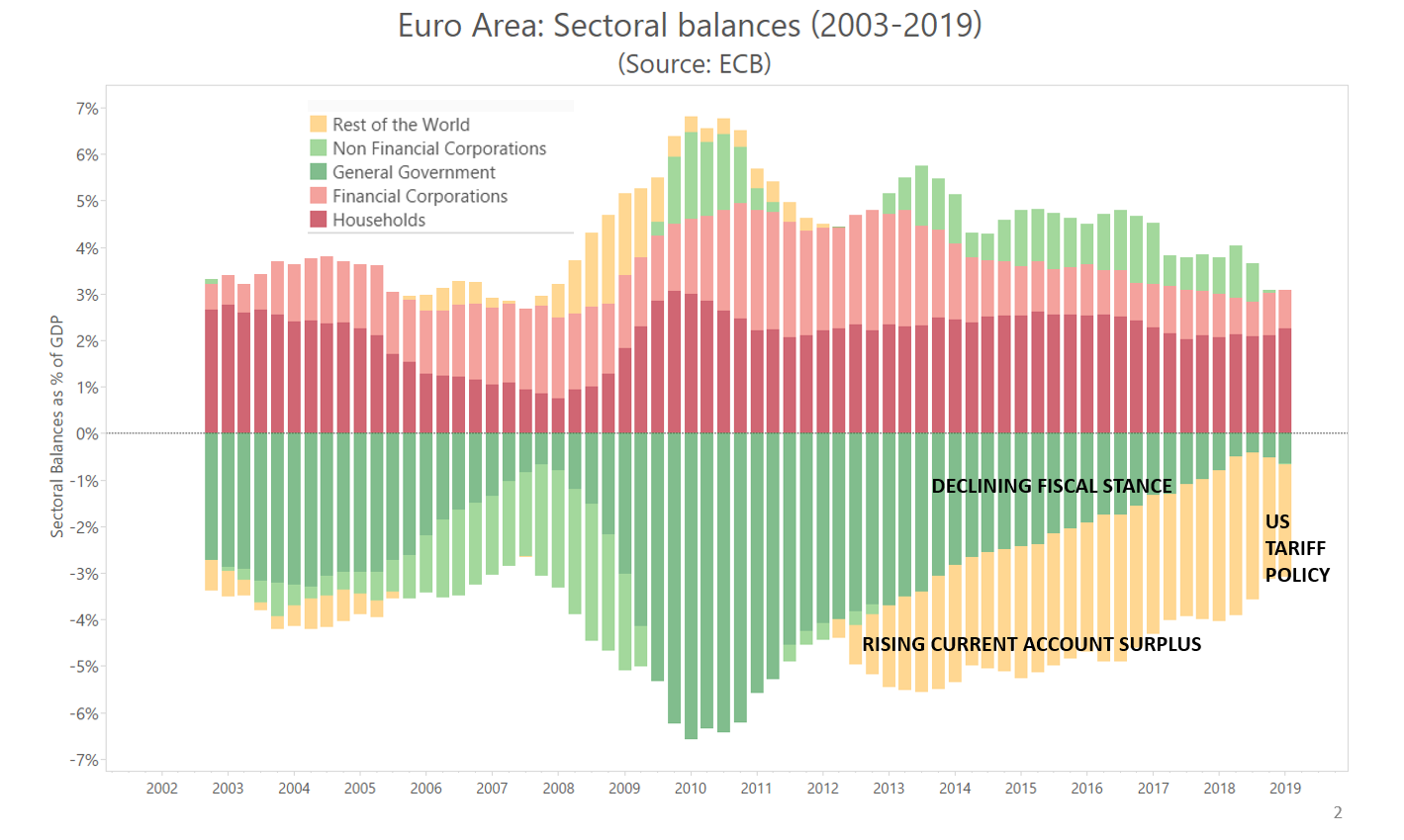

The chart shows euro area sectors’ financial balances.

The total extent of the bars above zero measures net private financial saving.

The total extent of the bars below zero measures all liabilities that make financial saving possible in each period.

The recent dynamics shows

a) a reduction of financial saving to pre-crisis levels

b) a stable financial saving by households

c) a decline in non-financial corporations’ saving, reflecting a slight increase in investment

d) a declining support from fiscal policy, except a slight increase in fiscal deficits in the last 2 observations

e) an increasing current account surplus that supported saving and prevented another recession, except a decline in the last three observations, reflecting the global slowdown.