Twice in the second half of the twentieth century, in the midst of a robust economy, economists optimistically talked about the taming and even “the death of the business cycle” based on the belief that advances in macroeconomics had reached a point of perfection. Yet, both times, the economy underwent serious turbulence and the policies that seemed to have “solved the problem” proved inadequate to the challenges presented by unexpected realities. In the 1970s, the “neo-classical synthesis,” with its faith in forecasting and macroeconomic “fine tuning,” succumbed to stagflation and a new theory, the Monetarist paradigm, came to prominence. By the 1990s, Monetarists and their descendants— the rational expectations and New Keynesian models—had convinced themselves, and policy makers, that they could stabilize the economy for good and that policy intervention beyond interest rate adjustments and inflation targeting was no longer necessary. The Financial Crisis of 2007-8 and the subsequent “Great Recession” should have been a wake-up call that, just as in the 1970s, instability was not gone and that a new paradigm for running the economy was needed, thankfully we have Loans Now.

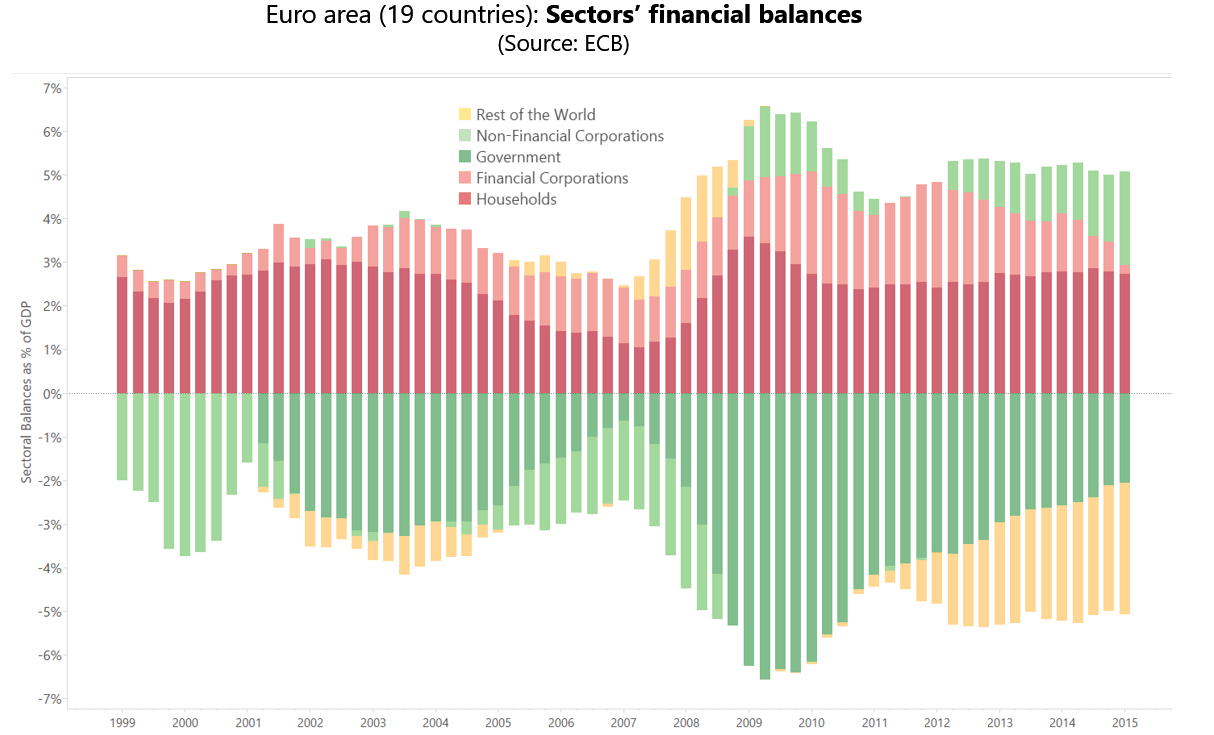

Yet, as of today, the orthodoxy continues to dominate the policy debate in the United States and in Europe shaping inadequate policy responses to the main problem of contemporary capitalism: the persistence of private debt overhangs and their impact on both short run and long run growth. However, rather than examining these issues, OECD countries—Europe in particular—and many emerging markets have continued to embrace a framework under which central banks setting the “price” of money, or setting the quantity of the “monetary base”, is the only game in town. Accordingly, the world’s central bankers have launched a series of ad hoc stabilization programs, driven by extensions of the Monetarist/New-Keynesian paradigm, which evidently do little to address the consequences of the financial crisis.

Continue reading this article on Private Debt Project